The NBP flooded Poland with cash. There are mainly high denominations

The National Bank of Poland flooded the market with high-denomination notes. As a result, the value of cash in circulation is almost twice as high as 5 years ago.

Nearly two months after the end of the second quarter, the National Bank of Poland presented data on the number of notes and coins in circulation at the end of this period. Official statistics leave no doubt – a record number of new banknotes has hit the Polish market. Importantly, they were mainly banknotes of the highest denominations.

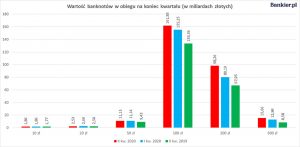

The most, as much as 82.4 percent. compared to last year, the number of 500 zloty banknotes increased. Compared to the first quarter of this year, 22 percent of them increased. Despite these increases, the total value of five hundred is still “only” PLN 15.6 billion. For comparison, the value of all PLN 100 banknotes in circulation is PLN 161.9 billion, and the value of PLN 200 banknotes is PLN 98.3 billion.

NBP is responding to demand

The increase in the number of high denominations in circulation is related to the increased demand for cash, which the NBP was trying to satisfy. The pandemic apogee of the supply of cash fell on March 12-17, when over PLN 18 billion was withdrawn from banks. Last week, President Adam Glapiński spoke about it in the Sejm.

– In March, we saw a huge increase in cash demand of market participants. We had runs for ATMs and bank counters. The demand for material money increased by 24%. We have satisfied this demand – said Adam Glapiński, presenting the report on the activities of the National Bank of Poland.

From the chronicler’s obligation, it can be added that in the second quarter of 2020, the number of lower-denomination banknotes also increased. In their case, however, the scale was not so large – on a quarterly basis, the 50s and 10s increased by 0.1%, while the 20s decreased by 4.8%. Compared to the previous year, the dynamics was, respectively: 18.2 percent. for PLN 50, 1.1 percent for PLN 20 and 5.4 percent for PLN 10.

In total, the value of all banknotes in circulation amounted to PLN 291.31 billion at the end of the second quarter. That’s 10.4 percent. more than a quarter earlier and 30.7 percent. more than a year earlier.

For a complete picture, the value of the coins can be added to these amounts, but it has remained marginal for years. At the end of the second quarter, all circulation coins were worth PLN 5.26 billion compared to PLN 5.15 billion at the end of the first quarter and PLN 4.9 billion at the end of the second quarter of 2019.

As a result, however, we can be sure that in the near future the total value of cash in Poland will exceed PLN 300 billion. This will mean a doubling of the result achieved only 5 years ago (PLN 150 billion in the second quarter of 2015).

Printing and inflation

Of course, the impact of the decline in the purchasing power of money on the fact that Poles who want to use cash need an increasing number of banknotes of ever higher denominations cannot be completely overlooked. There is no need to convince anyone that 10 or 20 years ago, PLN 100 could buy more than today, especially when it comes to basic products and services. On the other hand, the average gross salary at the beginning of 2000 was less than PLN 1,900, while now it is over PLN 5,000.

However, the increase in the number of banknotes in circulation itself should not be directly related to inflation – in the second quarter it resulted from a change in the preferences of money users. In other words, the prices of goods and services would increase anyway, even if people preferred to pay electronically, so that the NBP would not have to have more series of banknotes reprinted. In the era of e-money and cashless payments, the relationship is “prices have risen, so they will print” rather than “they are printing, so prices will rise”.

Nowadays, cash in circulation is only a narrow fragment of the general money supply, which the Polish central bank (and its counterparts in the world) has been able to increase for years without the need to use printing ink. The more so as the NBP is responsible only for a part of the money supply (coins and banknotes account for 16%), and the rest is created by commercial banks, only to a certain extent related to the central bank and the regulatory apparatus of the state. More on this subject in the article “Polish money is increasing the fastest in 12 years”.

It does not change the fact that if there are no fundamental changes in the financial system, we will still live in an inflationary reality in which we have to get used to an increase in prices and denominations or the number of banknotes in our wallets. We have to pay clearly more for the same services and goods than a few years ago. It is especially painful in the low interest rate environment, because without taking any additional risks, the value of our money decreases with each passing month.